Early 2025 surge collapses under shifting tariff policy.

America’s trade war with China has already impacted financial markets, rocking the U.S. dollar and battering the stock market. Now the trade war is having an impact on shipping volumes arriving in major U.S. container ports. And as fewer containers with Chinese goods are unloaded onto American soil, emptier shelves in American stores may soon follow close behind.

Across four major US shipping hubs analyzed by ImportGenius (the two busiest on both the Atlantic and Pacific coasts), total shipments of twenty-foot containers (TEUs) from around the world are down more than 16% from their February peak. And imports from China account for nearly all of that decrease.

“The uncertainty caused by tariffs is now arriving on American shores,” says ImportGenius President Christopher Schafer. “U.S. ports saw high volumes in the first two months of 2025 as importers bumped up orders to get ahead of the tariffs. Since then, the ever-changing tariffs on Chinese imports have resulted in a steep drop in shipments.”

Total arrivals from China at those four hubs — Los Angeles/Long Beach, Seattle/Tacoma, New York/Newark and Savannah — reached more than 1 million TEUs January, representing a 25% increase from the previous month. Another 1 million TEUs from China were unloaded in February 2025 before volumes then shrank by more than 20% in March and another 8% in April, when only 758,000 Chinese containers made it to port. All told, shipments from China have declined by 29.5% since their January peak.

This week, the U.S. and China announced that they would reduce tariffs for 90 days while they negotiate a new agreement. The tariff on Chinese imports now stands at 30%, but says Mr. Schafer, “it’s too early to predict just how that reduction will play out in the weeks ahead.”

Some ports harder hit than others

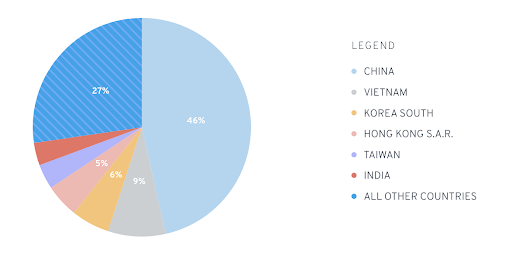

Nowhere is America’s import dependence on China more evident than in its container ports. Since the start of 2023, on average, China has accounted for 46% of total TEU shipments to the four major ports studied in this analysis. Vietnam is a distant second at 9%.

New York/Newark suffered the highest percentage decrease in shipments from China at over 43%, representing 69,000 fewer twenty-foot containers. This is likely due, at least in part, to its location: a container vessel needs an extra 10 to 20 days to travel from Los Angeles to New York, at a time when tariff announcements are changing weekly or daily.

But compared to other ports, New York/Newark is also less reliant upon Chinese shipments to begin with, as they account for 29% of all shipments in the last three years, significantly lower than the 46% average of the four hubs combined.

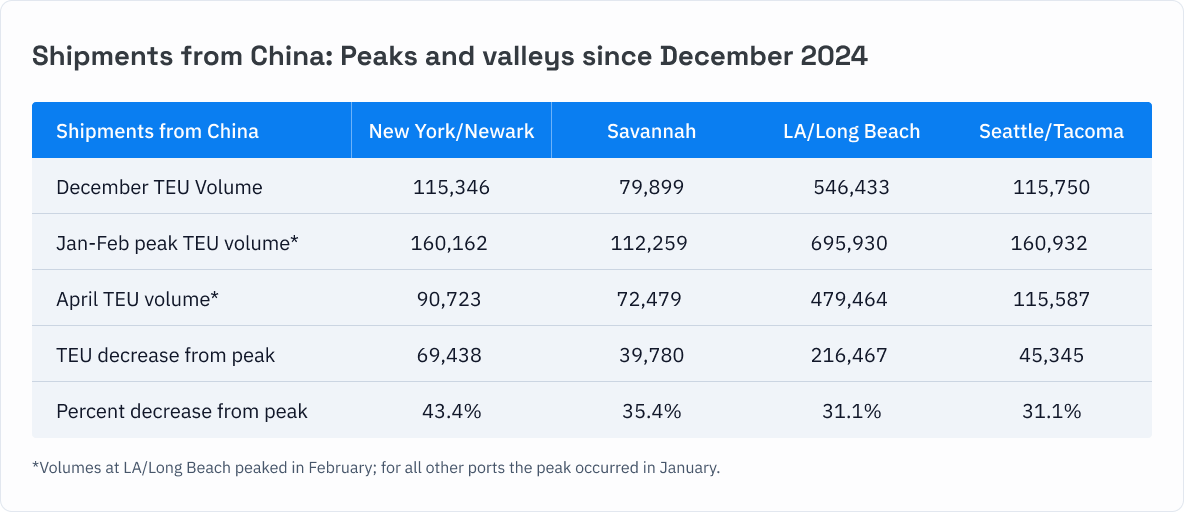

By contrast, 56% of all shipments arriving at Los Angeles/Long Beach since the start of 2023 have come from China, significantly higher than the recent average. There, the decrease in shipments from China totaled 216,000 TEUs, or more than triple the volume decrease in New York. Compared to the same time period in 2024, total volumes from China arriving at Los Angeles/Long Beach in January 2025 were higher by 20,000 TEUs, and in April 2025 were 100,000 TEUs lower. The table below shows the highs and lows for shipments from China for each port since the start of the year.

Shipments from China

The data shows significant increases from December to January and February, the result of frontloading as businesses pulled their imports from China forward, often warehousing them in anticipation of higher tariffs. The subsequent declines have been driven largely by ever-increasing tariff rates on Chinese imports and by companies that imported in bulk before the tariffs, satisfying demand from warehouse stockpiles. On March 4, the tariff rate was set at 10%. By April 9, it had risen to 104%, and on April 10, it reached 145%.

The burning question now is whether the new 30% tariff rate on Chinese imports, in effect for the next 90 days, will help volumes rebound. Container spot rates are currently low but could rise substantially if enough companies decide to act now, providing an advantage to first movers. Spot rates rose as high as $8,000/TEU last July, when companies first began frontloading in response to President Trump’s comments about tariffs during the election campaign.

“The lower tariff is welcome news, but it doesn’t make the business decisions any easier for importers,” says Mr. Schafer. “Do they place new orders now and pay the 30% tariff? Do they wait for the two countries to reach a better deal? Or do they avoid China altogether and seek out new suppliers elsewhere? These are not easy decisions, and the uncertainty could leave whole sectors of the economy stuck in neutral for a while yet.”