According to ImportGenius data, China supplies 90% or more of all U.S. imports in more than 200 product categories — and some will surprise you.

No Fourth of July celebration is complete without fireworks. But this summer, Americans might need to prepare for a fireworks shortage in stores — and for higher prices on the ones they can find. That’s because the vast majority of all American fireworks imports come from China, and the 145% tariff rates on Chinese goods mean that U.S.-based pyrotechnics distributors must either raise their prices or forego shipments altogether.

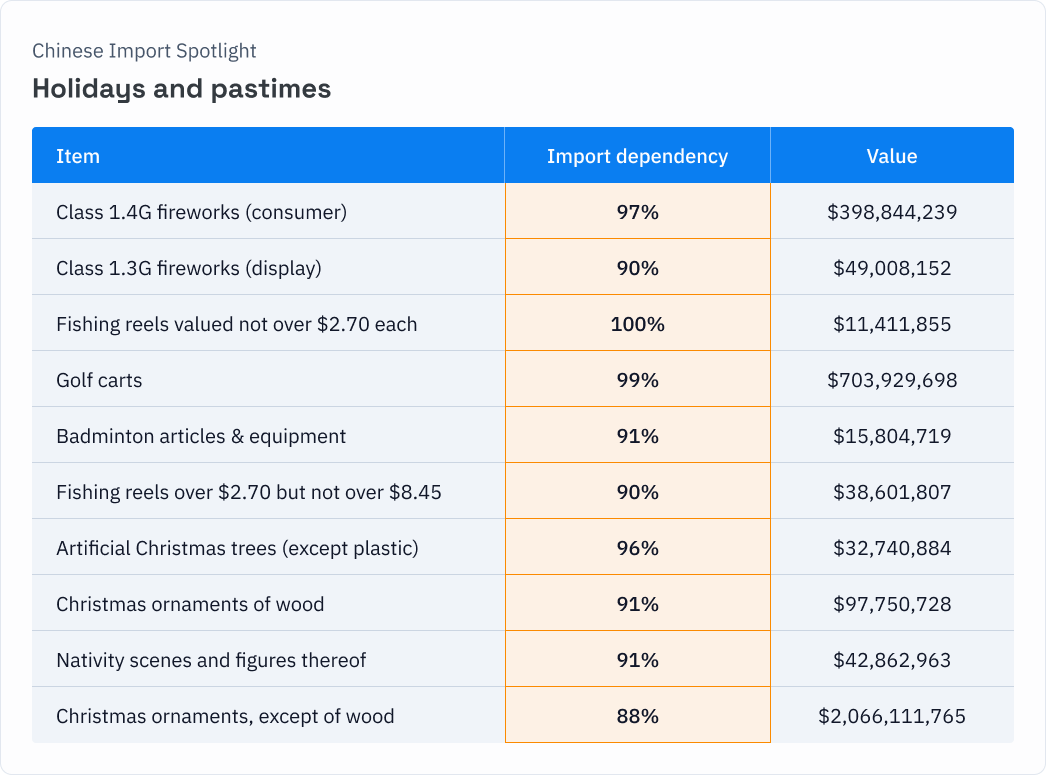

According to data compiled by ImportGenius, American businesses import nearly $400 million worth of Chinese consumer fireworks every year, accounting for 97% of all its fireworks imports from around the world.

And fireworks are just one of more than 200 products whose Chinese imports make up more than 90% of the total, creating a significant dependency: if supplies from China falter over tariffs for any of these products, there are few alternative suppliers elsewhere in the world to make up the shortfall.

The ImportGenius data shows that China delivers 100% of all U.S. imports for 19 different products, and 99% of imports for another 18 products. In all, China delivers more than 90% of total U.S. imports for 221 different products. Many American companies, feeling the squeeze of 145% tariffs on Chinese goods, have held back on their orders, with shipments plummeting by 45% as they seek out alternative suppliers.

The problem is that, for many products, alternatives can be hard to come by. “What stands out from our research is the breadth of American dependency on Chinese imports,” says ImportGenius President Christopher Schafer. “We depend on China for so much more than the home appliances we always hear about. For American importers looking for new suppliers, it’s an uphill battle. Our data can help them find it.”

Holidays and pastimes

Just as America’s Fourth of July fireworks come from China, so too do the festive icons associated with Christmas. The U.S. relies upon Chinese imports for everything from artificial Christmas trees to the baubles that adorn them and the crèches beneath. Chinese manufacturers now say their American buyers have stopped placing orders for Christmas items. Even beyond the holidays, other pastimes may also feel the pinch of tariffs.

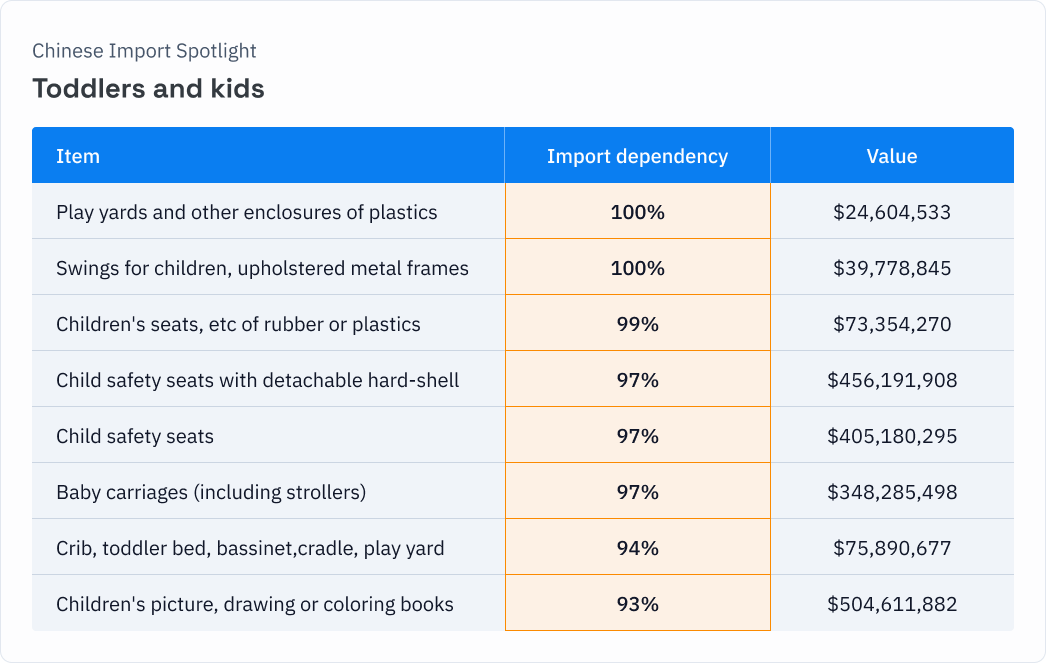

Kid stuff

No one will be more disappointed by a barren Christmas season than children, but parents have more immediate import dependencies to worry about. American parents can’t take their toddlers anywhere without Chinese imports — not even to the backyard playset. And while Crayola crayons are still manufactured in Pennsylvania’s Lehigh Valley, 93% of colouring books come from China.

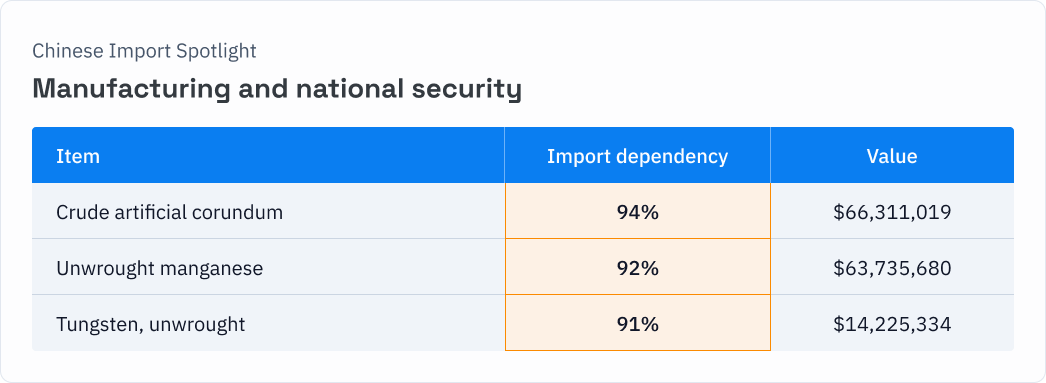

Manufacturing and national security

American dependency on Chinese imports reaches beyond the rituals and habits of daily life: the U.S. also relies upon China for key inputs for some of its own advanced manufacturing.

- Manganese is a chemical element essential for the production of glass and high-strength steel, from railways to heavy-duty machinery to gun barrels.

- Artificial corundum, also known as synthetic sapphire, is known for its hardness and is a key ingredient in the production of ceramic armor, used in both personal and vehicle armoring.

- Tungsten is a chemical element highly valued in multiple military applications, including armor-piercing rounds, grenades, artillery parts, aircraft and missiles.

Chinese Import Spotlight: Manufacturing and national security

| Item | Import Dependency | Value |

|---|---|---|

| Crude artificial corundum | 94% | $66,311,019 |

| Unwrought manganese | 92% | $63,735,680 |

| Tungsten, unwrought | 91% | $14,225,334 |

Scouring the globe for new suppliers

For businesses seeking to reroute their supply chains for these kinds of product, breaking the dependency on Chinese imports can be a daunting task — but it’s far from impossible. While China accounts for more than 90% of U.S. imports for the products listed above and more, there are other suppliers elsewhere in the world making up the difference, and all of them can be found in the ImportGenius database.

“Up until three weeks ago, American businesses believed their supply chains were robust and dependable,” says Schafer. “Now that we are in the midst of a trade war, that’s simply no longer the case.”

For business leaders, winning a trade war means having lots of alliances and partnerships scattered around the globe — and being able to call upon them when the timing is right. Most other countries are currently subject to a 10% tariff, far lower than China’s 145%. But that is slated to change when higher reciprocal tariffs kick back in this July. That prospect has many countries looking to strike a trade deal beforehand, which only clouds the future even more.

Until the dust settles, business leaders need to be prepared to diversify their suppliers to multiple parts of the world. “It’s hard to skate to where the puck is going when there are so many pucks in play,” says Schafer, “but that’s the game right now.”